At Neville Montagu, we provide a full suite of investment services designed for expatriates and international investors.

Whether you’re building, protecting, or transferring wealth, our goal is to make global investing simple, compliant, and effective so your portfolio works seamlessly across borders.

Our Risk Managed Investment Portfolio service offers a structured, transparent approach to global investing, tailored precisely to your comfort level with risk. We offer five distinct portfolios Defensive, Cautious, Balanced, Growth, and Speculative each meticulously designed to align with a specific financial objective and risk tolerance.

The defensive portfolio aims for capital preservation and minimal volatility, making it suitable for those nearing retirement or with a low-risk mindset.

Conversely, our speculative option targets maximum long-term growth for clients with a high tolerance for market fluctuations.

Our expert team continuously monitors and rebalances these diversified portfolios, ensuring they remain strategically aligned with your goals while mitigating global market risks. By placing your assets within a professionally managed framework, you gain peace of mind and the clarity needed to track your progress toward smart, growth-driven investing, fully optimised for your offshore status.

Personalised strategies for complex, global wealth

Our Bespoke Investment Management service delivers fully tailored investment strategies built around your lifestyle, residency, and financial ambitions. We integrate multi-asset diversification equities, fixed income, alternatives, private markets, and real assets with intelligent risk management and tax-aware structuring.

Unlike standard portfolios, every element of your investment plan is customised to reflect your goals and jurisdictional needs. You benefit from direct access to global opportunities and proactive advice that adapts as your circumstances change.

Experience truly personalised portfolio management crafted for expats by experts.

Managing your retirement savings across international borders is a core specialism at Neville Montague.

Our expert team focuses on the efficient and fully compliant transfer of cross-border pensions, primarily through Qualifying Recognised Overseas Pension Schemes (QROPS) and Self-Invested Personal Pensions (SIPPs). Navigating the regulatory landscape of different jurisdictions can be fraught with complexity and potential tax penalties; we ensure that your transfer is handled meticulously, adhering to both the sending and receiving country’s regulations.

By consolidating your various pension pots into a single, offshore-friendly structure, we provide a unified platform for investment growth, offer greater currency flexibility, and often unlock more favourable tax treatment for your retirement funds.

Our comprehensive service protects your hard-earned retirement savings, simplifying your financial life so you can focus on where you choose to enjoy your retirement.

Building a successful international property portfolio requires more than just capital; it demands efficient structuring.

Our Property Investment Service, complemented by our in-house company incorporation expertise, is designed to simplify this process for expatriate investors. We guide you through setting up a dedicated company structure (such as an International Business Company or similar entity) which can often provide significant advantages in terms of tax efficiency, inheritance planning, and simplified ownership across jurisdictions.

Once your structure is established, our team assists you in securing appropriate offshore financing and sourcing high-potential investment properties worldwide. This streamlined service removes the administrative burden, allowing you to quickly start growing a diversified property portfolio that aligns with your long-term wealth strategy, all within a legally sound and tax-optimised framework.

For the global expatriate, efficient and cost-effective international money movement is an ongoing necessity.

Our Currency Transfer Service is designed to streamline your international transactions while proactively managing exchange rate risk. Dealing with banks can be slow and expensive; we provide a specialist service that offers competitive exchange rates and lower transfer fees for both regular payments and large investment transfers.

Crucially, our expert advice extends to offering sophisticated tools like spot trades, forward contracts, and limit orders. This allows you to lock in favourable exchange rates for future transactions or set a specific target rate, protecting your capital from unexpected market volatility.

Whether you are paying a mortgage, repatriating salary, or funding an investment, our secure and efficient currency service ensures you optimise costs and minimise risk with every transfer.

As a timeless asset, gold and other precious metals offer an essential component of portfolio diversification, acting as a hedge against inflation and market volatility.

At Neville Montague, we help clients access this stability through secure and flexible investment options. You can choose to invest in physical gold bullion stored securely in regulated, non-bank vaults providing you with direct ownership of a tangible asset.

Alternatively, we facilitate investment through Gold Exchange-Traded Funds (ETFs), which can be easily incorporated into your main investment portfolio or offshore bond for added liquidity and tax efficiency.

Our tailored strategies ensure that your gold investments align seamlessly with your overall financial goals, providing a solid foundation of stability and growth potential within your internationally diversified wealth structure.

Expatriate and offshore investors often face a unique set of hurdles when seeking finance, including issues around complex tax residency, fluctuating currency, and stringent lending criteria for non-residents.

Our Mortgage Finance Service specialises in providing tailored, effective solutions to secure financing for your international property, and portfolio investments.

We have established relationships with a global network of lenders who understand the specific profiles of expatriate income and circumstances. This allows us to cut through the red tape and secure competitive mortgage products for properties in a variety of jurisdictions.

We provide end-to-end guidance, from initial application to final completion, ensuring the financing is structured efficiently to complement your wider investment and tax planning objectives.

Book a call with our specialists today to turn your international property goals into reality.

Bespoke offshore investment, tax, and estate solutions for internationally mobile professionals and families.

In addition to our core services, other elements of expat wealth management are crucial for a fully protected and growth-oriented financial life:

For many expatriates, an Offshore Investment Bond acts as a highly efficient tax wrapper, a structure designed to hold a wide range of underlying investments (such as mutual funds, equities, and ETFs) under one legal umbrella. These bonds are particularly attractive as they offer tax deferral on gains until withdrawals are made, which can be a significant advantage if you anticipate moving to a lower-tax jurisdiction in the future. They are highly portable, meaning they can move with you across borders without the need for constant restructuring, and often offer estate planning benefits by simplifying the distribution of assets upon death, bypassing potentially complex local probate laws. We select high-quality, transparent bond providers and advise on the appropriate investment strategy within the wrapper to maximise its tax and portability advantages for your international life.

For high-net-worth expats, wealth management extends beyond investment returns to include multi-generational planning.

Our Cross-Border Wealth and Estate Planning Service is critical for navigating the often-conflicting inheritance and tax laws of multiple countries. We help you establish legally compliant, internationally recognised wills, trusts, and power of attorney documents that ensure your assets are protected and distributed according to your exact wishes. This service addresses complex issues like UK Inheritance Tax (IHT) tail risk, Double Tax Treaties, and compliance with global reporting standards (like CRS and FATCA).

By proactively structuring your global assets, we help you minimise tax exposure, ensure family wealth succession is smooth, and safeguard your legacy across every jurisdiction you have ties to.

Not all expats have a lump sum ready to invest; many require a steady, disciplined approach to build long-term capital. Our Regular Savings and Accumulation Plans allow you to contribute fixed amounts periodically to an internationally diversified portfolio. This strategy is ideal for saving for future goals such as university school fees, a major purchase, or simply building a secondary retirement fund. By investing regularly, you benefit from cost averaging, which mitigates the risk of investing a large sum at a market peak. These plans are designed with the flexibility an expat needs, offering the ability to adjust contributions or access funds as your circumstances change, providing a secure and consistent pathway to achieving your mid-to-long term financial objectives.

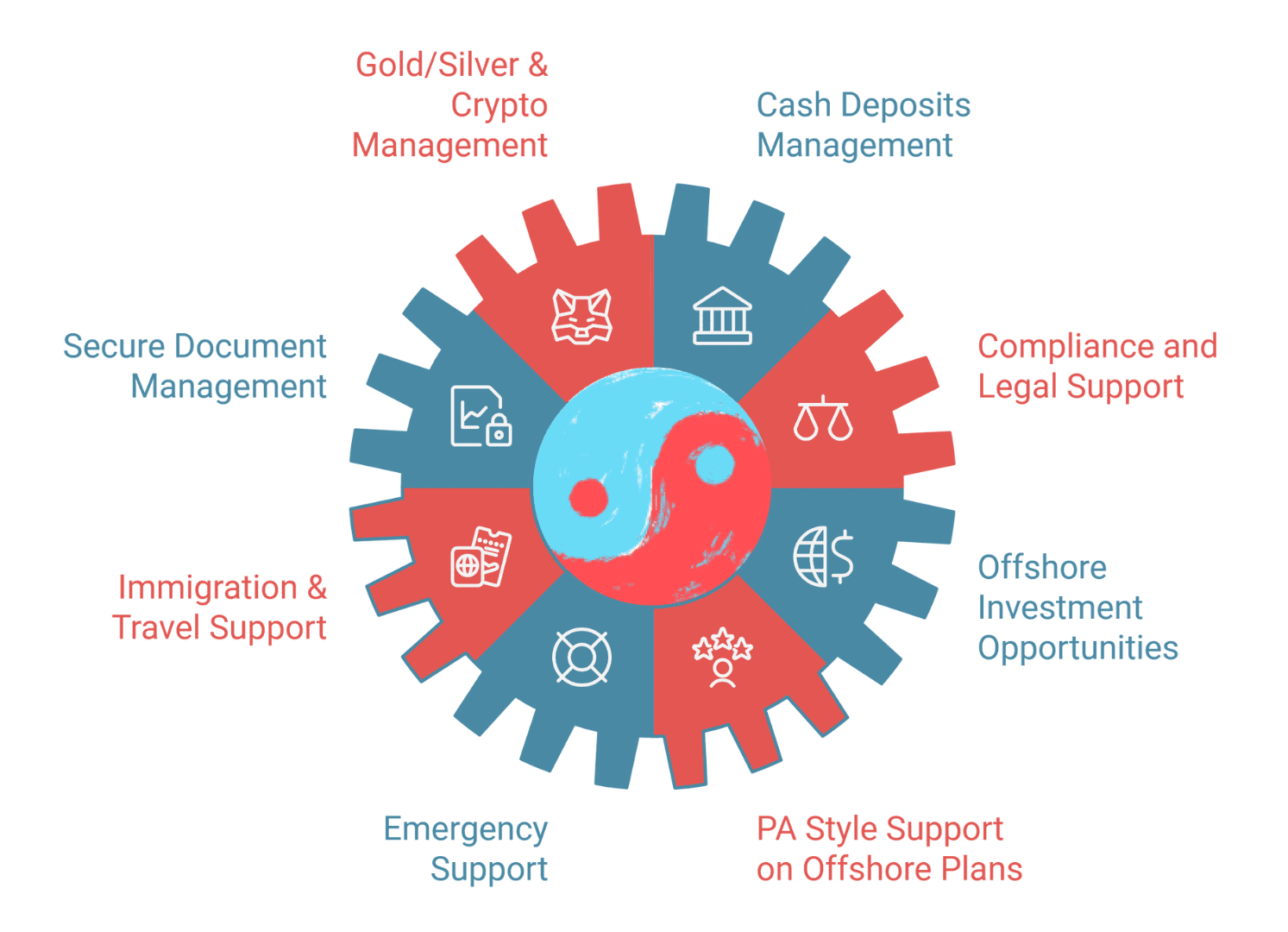

Our client Hub offers Personalized Assistance, Full Crisis Support, Efficient Solutions, and time and cost savings. Delivered across timezones concierge style.

Finely tuned over the years to provide convenience and efficiency our Client Hub, will help you manage all your offshore requirements under one secure roof.

Accessible anytime, anywhere, our Client Hub ensures streamlined communication, real-time updates, and comprehensive oversight of your offshore ventures. At the Neville Montague Group, we are dedicated to delivering transparent, reliable, and client-centric services that empower you to thrive in the global marketplace.

With 24-hour concierge-style support services.

Our services come with access to 24-hour crisis support.

This content is for background information only. It is not investment advice, a recommendation, or an offer of services. While based on sources Neville Montagu believes to be reliable, it is provided without warranty of accuracy. Unauthorised use is strictly prohibited. Neville Montagu and any of its partners accept no liability for any loss arising from the use of this information.

Neville Montagu is an appointed representative of Neba Wealth Management (NEBA), Head Office: 15-3 Menara 1MK 50480, Kuala Lumpur, Malaysia. www.nebawealth.com

‘NEBA ’ refers to the Neba Wealth Management Group’s separate but affiliated entities generally, rather than to one particular entity. These entities are NEBA Private Clients, which is licensed to operate in multiple regions. NEBA Private Clients Pte Ltd is licensed by the Monetary Authority of Singapore (MAS); NEBA Insurance Brokerage is registered with the Central Bank of the UAE (CBUAE); NEBA Private Clients Financial Advisors LLC is licensed by the Securities and Commodities Authority (SCA) UAE; NEBA Private Clients Ltd is registered with the Labuan Financial Services Authority (LFSA) in Malaysia; NEBA Private Clients (PTY) Ltd, authorised by the Financial Sector Conduct Authority (FSCA) in South Africa. NEBA Private Clients UK is licensed by the Financial Conduct Authority (FCA)

If you are a client outside the United Kingdom, please note that our services are not covered by the UK’s regulatory framework. This means that protections from the Financial Conduct Authority (FCA) and the UK Financial Ombudsman Service will not apply. Instead, your relationship with us will be governed by the laws and dispute resolution processes of the jurisdiction where you receive our services, which will differ from those in the UK.

The investment return and the principal value are subject to market fluctuations. Consequently, an investment, upon redemption, may be worth less than the initial amount invested. Past performance is not indicative of future returns, and we cannot guarantee the success of any investment strategy.

Neville Montagu Group, Hudson House, 8 Albany Street, Edinburgh EH1 3QB

© 1998 – 2025 Neville Montagu