We offer several ways to arrange your free fact finding consultation. We can hold meetings over Telephone, WhatsApp, Telegram, Zoom, or any other method convenient for you. Please contact us or schedule your appointment on our calendar directly.

You do not need to be super rich to benefit from our services, our strategies are holistic and built around your personal circumstances.

We offer several ways to arrange your free fact finding consultation. We can hold meetings over Telephone, WhatsApp, Telegram, Zoom, or any other method convenient for you. Please contact us or schedule your appointment on our calendar directly.

The meeting involves an in-depth Fact find so we can really understand your objectives. We will also present our initial ideas on we feel we can offer you value.

We will discuss the process and specify the timeframe within which we expect to achieve the completion of your plan. We will cover the benefits as well as any potential disadvantages and provide an estimate of the costs.

Once you are happy to proceed, we will issue you with our client agreement and request a retainer.

This is a multiweek process and may involve several meetings during the period. We do most of the work behind the scenes.

We will present your plan in a full written report which we will discuss with you at great length. There are no limits on the number of meetings, adjustments, and input. It’s important we get this right.

At this stage, as we have established the costs, we will agree on a fixed price for all services and ongoing management, or if there are commissions earned these are openly discussed and set against fees. This is fixed no hidden fees, or double charging or surprise amendments.

Your new fully refined Offshore Plan will be implemented.

As this normally involves the opening of Investment and Bank Accounts, Trusts, Company Formations, Immigration applications. It's difficult to provide an exact time line of how long this takes. We handle everything for you all under one roof.

Your team will be available for you at anytime. You will also have full access to our Client Hub and Concierge Support Services.

We offer several ways to arrange your free consultation. We can hold meetings over Telephone, WhatsApp, Telegram, Zoom, or any other method convenient for you.

Please contact us or schedule your appointment on our calendar directly.

We can schedule meetings very quickly if you need this.

During the first meeting, we will conduct an in-depth fact find to focus on you and do our best to ascertain your current situation, needs and goals for the future.

We will discuss practical examples and present our initial ideas that may be of benefit to you now and in the future. We will only make this offer if we feel we can offer you true value.

At this stage, we will give you our best estimate of the process timeframe, how long we feel we will need to complete your plan design along with estimated costs.

Together we can ascertain if we are a good fit for you and vice versa. If you are happy to proceed, we will issue you with our client agreement and request our initial retainer normally around 25% of estimated total costs.

We take a retainer at this stage as the research phase is where we and our partners get to work on your behalf designing your plan. This normally involves generating bespoke advice and strategies across a broad spectrum of subject areas. For example, can involve in-depth legal, tax, asset protection and immigration advice. We incur costs and spend a great deal of time on your behalf.

If at the onboarding phase you decide not to proceed don’t worry, we refund the retainer minus our hourly fees. ($250 /hr max bill $2,500). You walk away with the full bespoke plan.

This is a multi-week process and may involve several conversations with you during the period. We do most of the work behind the scenes.

We will present your plan in a full written report which we will discuss with you at great length. There are no limits on the number of meetings, adjustments, and input. We must get this right.

As the research is complete and we have agreed to move forward we will provide an accurate updated quotation.

We will agree on a fixed price for all services and ongoing management for the next 12 months. This is fixed no hidden fees or surprise amendments.

We do not operate a budget service. we use the highest quality partners. Our years of experience and partners across the globe allow us to pass on considerable savings to our clients. This greatly enhances the competitiveness of our services.

It’s time for us to get to work implementing your plan.

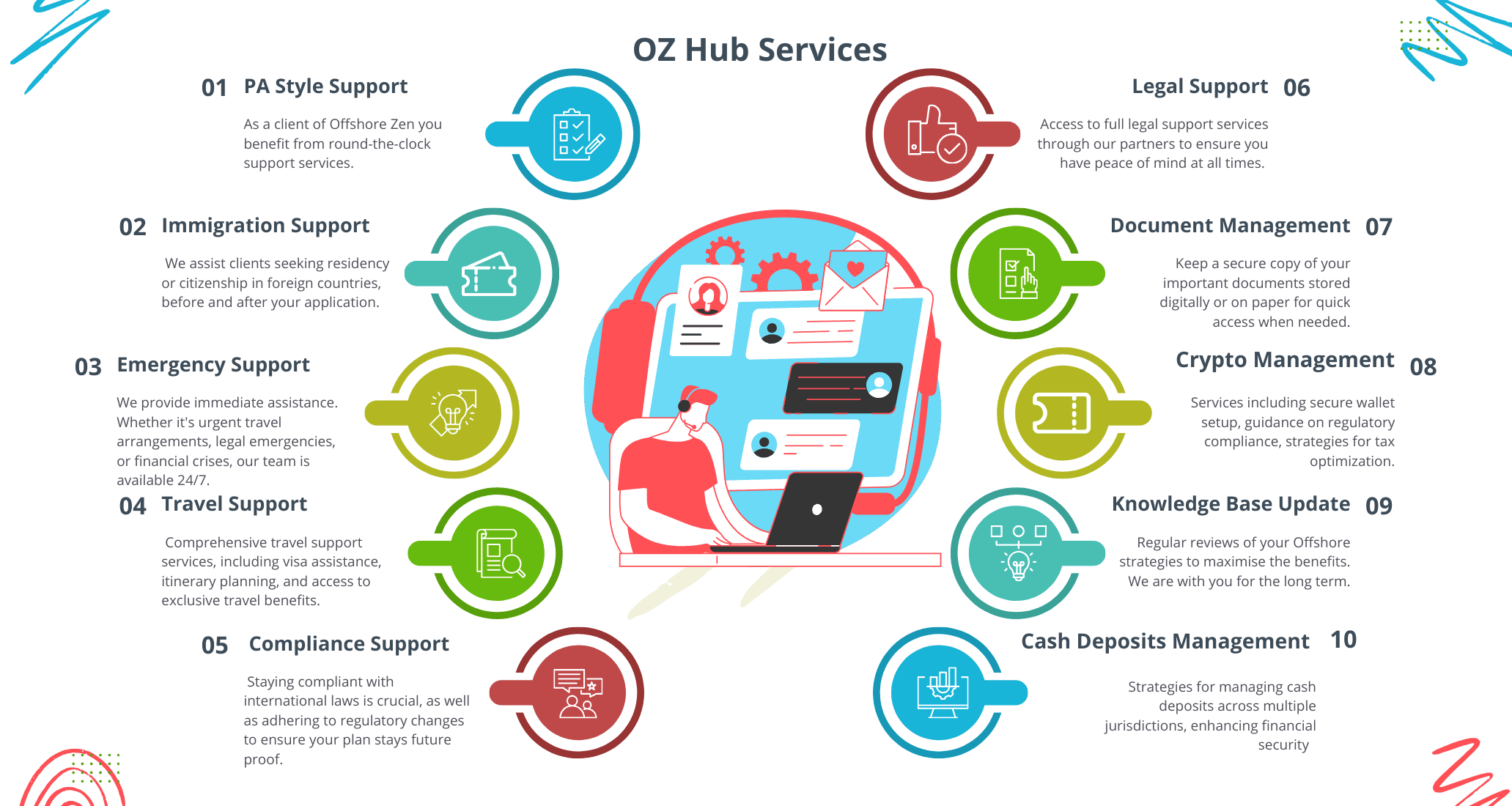

Your team will be available for you at any time. You will also have full access to our Client Hub and Concierge Support Services.

This process normally involves the opening of Bank Accounts, Trusts, Company Formations, and Immigration applications. It’s difficult to provide an exact timeline of how long this will take.

We handle everything for you all under one roof. You will be able to monitor progress via the Hub.

Your team will be available for you at any time via your preferred contact method. This could be via Telephone, Hub Secure chat, WhatsApp, Telegram, Signal or email.

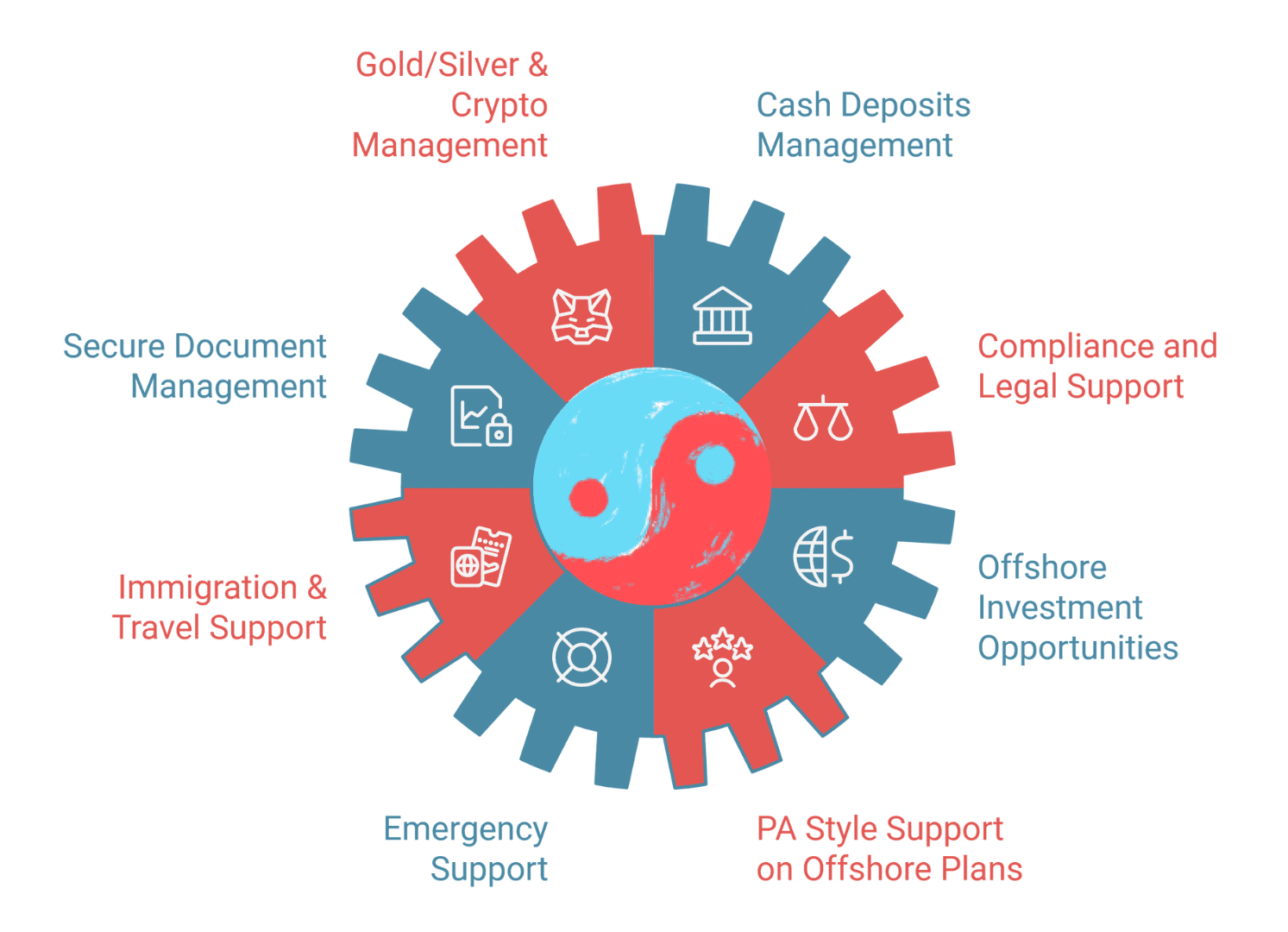

With access to the hub comes access to the Concierge Services.

Our client Hub offers Personalized Assistance, Full Crisis Support, Efficient Solutions, and time and cost savings. Delivered across timezones concierge style.

Finely tuned over the years to provide convenience and efficiency our Client Hub, will help you manage all your offshore requirements under one secure roof.

Accessible anytime, anywhere, our Client Hub ensures streamlined communication, real-time updates, and comprehensive oversight of your offshore ventures. At OffshoreZen.com, we are dedicated to delivering transparent, reliable, and client-centric services that empower you to thrive in the global marketplace.

With 24-hour concierge-style support services.

All Plans come with access to 24-hour crisis support.

Our 24/7 client Hub service offers all of our clients support in normal day-to-day activities as well as in times of crisis.

As such, our growth is limited to ensure an ongoing high-value service for all our clients.

This content is for background information only. It is not investment advice, a recommendation, or an offer of services. While based on sources Neville Montagu believes to be reliable, it is provided without warranty of accuracy. Unauthorised use is strictly prohibited. Neville Montagu and any of its partners accept no liability for any loss arising from the use of this information.

Neville Montagu is an appointed representative of Neba Wealth Management (NEBA), Head Office: 15-3 Menara 1MK 50480, Kuala Lumpur, Malaysia. www.nebawealth.com

‘NEBA ’ refers to the Neba Wealth Management Group’s separate but affiliated entities generally, rather than to one particular entity. These entities are NEBA Private Clients, which is licensed to operate in multiple regions. NEBA Private Clients Pte Ltd is licensed by the Monetary Authority of Singapore (MAS); NEBA Insurance Brokerage is registered with the Central Bank of the UAE (CBUAE); NEBA Private Clients Financial Advisors LLC is licensed by the Securities and Commodities Authority (SCA) UAE; NEBA Private Clients Ltd is registered with the Labuan Financial Services Authority (LFSA) in Malaysia; NEBA Private Clients (PTY) Ltd, authorised by the Financial Sector Conduct Authority (FSCA) in South Africa. NEBA Private Clients UK is licensed by the Financial Conduct Authority (FCA)

If you are a client outside the United Kingdom, please note that our services are not covered by the UK’s regulatory framework. This means that protections from the Financial Conduct Authority (FCA) and the UK Financial Ombudsman Service will not apply. Instead, your relationship with us will be governed by the laws and dispute resolution processes of the jurisdiction where you receive our services, which will differ from those in the UK.

The investment return and the principal value are subject to market fluctuations. Consequently, an investment, upon redemption, may be worth less than the initial amount invested. Past performance is not indicative of future returns, and we cannot guarantee the success of any investment strategy.

Neville Montagu Group, Hudson House, 8 Albany Street, Edinburgh EH1 3QB

© 1998 – 2025 Neville Montagu