At Neville Montagu, we provide a full suite of investment services designed for expatriates and international investors.

Discover tailored financial solutions for expats from portfolio optimisation and pension consolidation to tax efficiency, wealth growth, and retirement planning, all designed to secure your financial future with expert guidance.

At Neville Montagu, every financial plan should start with your aspirations, circumstances, and global lifestyle.

Designing your financial plan involves creating a clear, coordinated roadmap for your wealth. We assess your assets, income, liabilities, and residency status to build a tailored plan that balances risk, opportunity, and structure.

For internationally mobile clients, we integrate cross-border considerations, tax obligations, and regulatory frameworks to ensure compliance and efficiency.

Whether you aim to grow, protect, or transfer wealth, our holistic approach aligns every element from investments and pensions to estate and asset protection. The result is a dynamic, living plan that evolves as your life changes, new jurisdictions, family milestones, or business ventures. With Neville Montagu, you gain more than advice; you gain a strategic blueprint for lasting financial success.

Personalised strategies for complex, global wealth

Effective tax planning for expatriates is about far more than just filing returns; it is a dynamic, ongoing strategy to legally minimise your global tax burden and avoid the pitfalls of double taxation.

Our Optimise Your Tax Strategy service is specifically designed to navigate the complexities of your home and host country’s fiscal laws. We expertly assess your tax residency status, domicile, and the applicability of Double Taxation Treaties (DTTs), ensuring that you are only taxed once and in the correct jurisdiction.

This may include strategically structuring your investment holdings within tax-efficient offshore wrappers, utilising tax deferral opportunities, and advising on the optimal timing of income and capital gains realisation.

For high-net-worth individuals, we ensure meticulous compliance with international disclosure requirements, such as FATCA and CRS, providing peace of mind.

Our objective is to design a robust, transparent, and compliant structure that transforms tax efficiency into a significant accelerator of your long-term wealth accumulation.

Your retirement savings must be as mobile and flexible as you are.

Our Optimise Pension Planning service focuses on consolidating, protecting, and growing your retirement funds in a manner compliant with international regulations. We offer specialist advice on QROPS and SIPPs transfers, evaluating whether moving your defined benefit (DB) or defined contribution (DC) schemes offshore is the most tax-efficient and flexible option for your retirement location.

Our analysis extends to coordinating pension contributions across multiple countries, ensuring you benefit from all available tax reliefs while avoiding any potential tax penalties for cross-border schemes.

We structure your retirement funds to offer currency diversification and a wider range of investment options than may be available domestically, ultimately maximising your future income.

Our guidance ensures that no matter where you choose to retire, your pension will be ready, well-funded, and managed with the utmost efficiency.

Estate Planning for expatriates is exceptionally complex due to the interplay of different countries’ succession, inheritance, and tax laws. Our service is designed to secure your global legacy and ensure the smooth, tax-efficient transfer of assets to the next generation.

We specialise in drafting cross-border wills that cover assets in multiple jurisdictions, preventing potential legal conflicts and expensive probate processes.

A key focus is addressing the often-overlooked issue of domicile and its impact on your potential exposure to home-country inheritance taxes (such as UK IHT), even after years of living abroad. We work with legal specialists to establish tax-efficient structures like trusts and foundations that bypass forced heirship rules and provide generational protection.

By proactively aligning your wishes with the legal and fiscal realities of a global life, we deliver peace of mind that your wealth will be distributed exactly as intended, without unnecessary delay or erosion by taxation.

Living abroad exposes you to new risks, making Protection Planning an essential pillar of your financial security.

Our service ensures that you and your family are fully protected against life’s uncertainties with portable, cross-border solutions.

We advise on comprehensive International Private Medical Insurance (IPMI), ensuring high-quality healthcare coverage that travels with you, regardless of your host country.

Furthermore, we structure global Life Insurance and Critical Illness Cover to provide a financial safety net for your dependents, often in the most tax-efficient structure.

For the expat, portability is key; we select policies that maintain their validity and value even as your country of residence changes.

This approach safeguards your current income, protects your wealth from being depleted by unforeseen health crises, and guarantees that your financial goals remain on track, offering complete security and stability in an ever-changing world.

In a world of increasing legal and financial scrutiny, Asset Protection is vital for high-net-worth expatriates.

Our service focuses on legally fortifying your wealth against potential risks, including political instability, creditor claims, and unforeseen business liabilities.

The primary tool in this strategy is the strategic use of Offshore Trusts and Foundations. By transferring legal ownership of assets to a well-structured and properly administered trust in a politically and financially stable offshore jurisdiction, you can secure your wealth outside of your country of residence.

This separation of ownership can provide a robust layer of protection, ensure continuity of management, and facilitate smooth succession planning.

We work closely with specialist fiduciary partners to design a structure that is fully compliant, effective for your specific jurisdiction, and provides the maximum possible security and confidentiality for your family’s wealth for generations to come.

Citizenship Planning is a strategic service for individuals seeking enhanced global mobility, greater economic freedom, and a personal “Plan B.”

We advise on reputable Citizenship by Investment (CBI) programs offered by stable nations, which legally grant a second passport in exchange for a qualifying investment. This is not just about a travel document; it is a financial decision with profound implications for your global wealth structure.

A second citizenship can open doors to new markets, simplify banking, and provide a critical hedge against political or economic uncertainty in your home country.

Our service involves a full evaluation of how acquiring a new citizenship impacts your tax residency, estate planning, and overall financial goals, ensuring the chosen program integrates seamlessly with your existing wealth structure.

Whether as a client of Neville Montagu or our subsidiary OffshoreZen.com. We guide you through the entire process, from initial due diligence to final passport issuance.

Relocating internationally requires more than paperwork it demands strategic alignment between lifestyle, tax, and financial goals.

Neville Montagu’s migration advisory service helps you plan and execute moves that work for your wealth and family.

We guide clients through investor and entrepreneur visa programmes, permanent residency applications, and long-term migration strategies. By collaborating with immigration and tax professionals worldwide, we ensure your move supports rather than disrupts your financial plan.

Our advice covers pre-departure tax planning, residency implications, business and property structuring, and succession considerations. Whether relocating for opportunity, lifestyle, or retirement, we provide a smooth, compliant process from start to finish.

With Neville Montagu, your relocation becomes an integrated part of your financial strategy, strategic, secure, and seamless.

Global mobility brings freedom but also financial complexity. At Neville Montagu, we help internationally mobile clients plan relocations that align with wealth, tax, and lifestyle objectives.

Our mobility planning service covers every stage from residency evaluation and timing your move for tax efficiency, to integrating relocation with pension, property, and investment planning.

We work alongside relocation experts, tax consultants, and legal advisors to ensure full compliance and strategic coherence.

Whether you’re transferring employment, expanding a business, or retiring abroad, we coordinate the financial framework to make the transition seamless.

This includes currency management, property acquisition, cross-border reporting, and repatriation planning.

The result is a move that enhances rather than disrupts your wealth strategy.

With Neville Montagu as your partner, global mobility becomes a confident step forward—not a financial risk.

US citizens and Green Card holders face a unique and particularly challenging financial environment due to the US policy of citizenship-based taxation.

Our dedicated service for US Expats is essential for navigating this complexity. We specialise in structuring investments and savings that are compliant with both US and local host-country regulations, a critical distinction as many non-US financial products carry punitive US tax consequences (e.g., PFIC rules).

We advise on tax-efficient US-compliant solutions, such as specific non-US mutual funds and life insurance products, and help you manage your reporting obligations, including FBAR (FinCEN Form 114) and your annual US tax return.

Our expertise is focused on helping you leverage benefits like the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credits, while ensuring that your global wealth planning remains compliant and efficient, protecting you from potential penalties and double taxation.

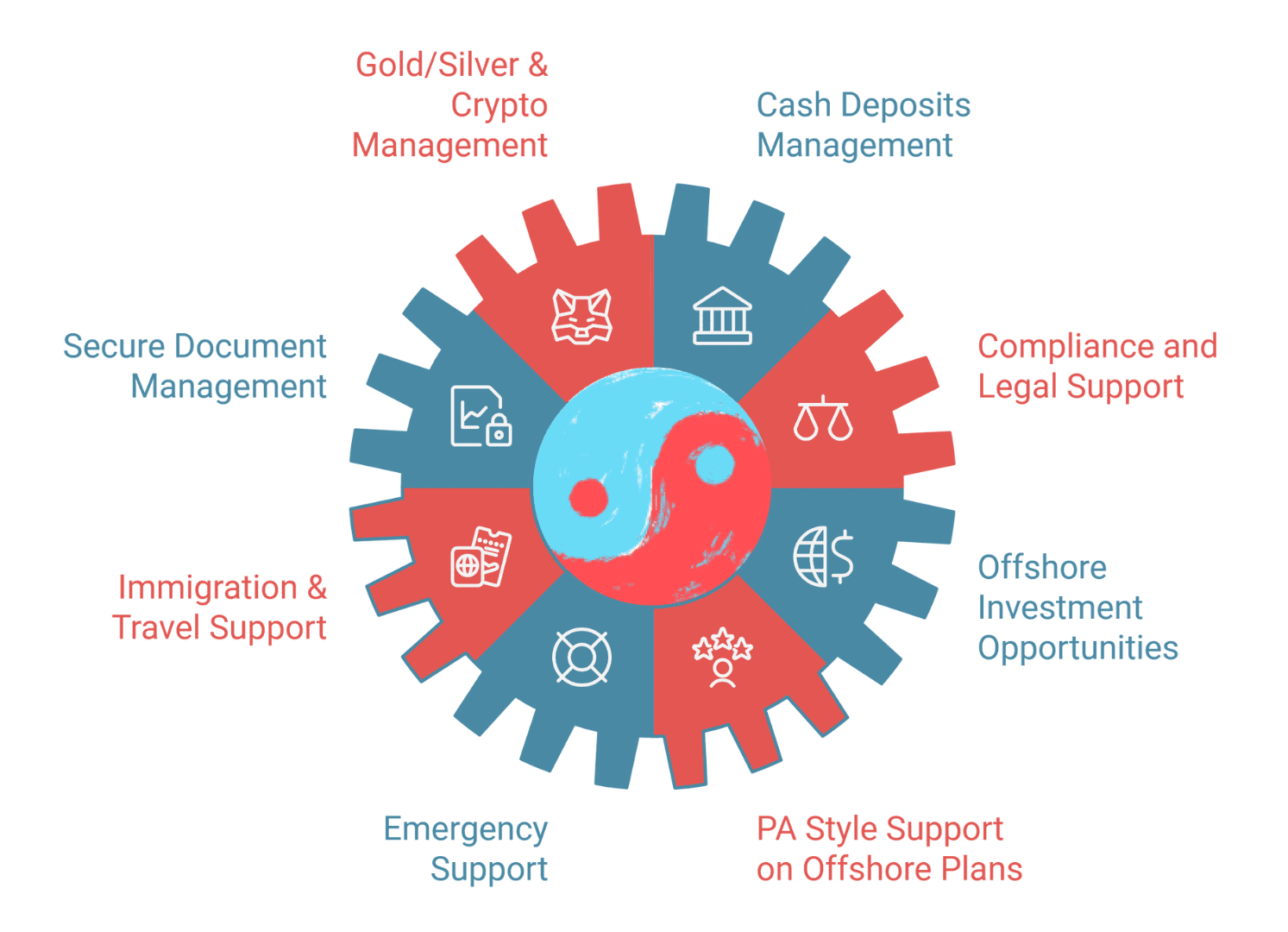

Our 24/7 client Hub service offers all of our clients support in normal day-to-day activities as well as in times of crisis.

As such, our growth is limited to ensure an ongoing high-value service for all our clients.

Our client Hub offers Personalized Assistance, Full Crisis Support, Efficient Solutions, and time and cost savings. Delivered across timezones concierge style.

Finely tuned over the years to provide convenience and efficiency our Client Hub, will help you manage all your offshore requirements under one secure roof.

Accessible anytime, anywhere, our Client Hub ensures streamlined communication, real-time updates, and comprehensive oversight of your offshore ventures. At the Neville Montague Group, we are dedicated to delivering transparent, reliable, and client-centric services that empower you to thrive in the global marketplace.

With 24-hour concierge-style support services.

Our services come with access to 24-hour crisis support.

This content is for background information only. It is not investment advice, a recommendation, or an offer of services. While based on sources Neville Montagu believes to be reliable, it is provided without warranty of accuracy. Unauthorised use is strictly prohibited. Neville Montagu and any of its partners accept no liability for any loss arising from the use of this information.

Neville Montagu is an appointed representative of Neba Wealth Management (NEBA), Head Office: 15-3 Menara 1MK 50480, Kuala Lumpur, Malaysia. www.nebawealth.com

‘NEBA ’ refers to the Neba Wealth Management Group’s separate but affiliated entities generally, rather than to one particular entity. These entities are NEBA Private Clients, which is licensed to operate in multiple regions. NEBA Private Clients Pte Ltd is licensed by the Monetary Authority of Singapore (MAS); NEBA Insurance Brokerage is registered with the Central Bank of the UAE (CBUAE); NEBA Private Clients Financial Advisors LLC is licensed by the Securities and Commodities Authority (SCA) UAE; NEBA Private Clients Ltd is registered with the Labuan Financial Services Authority (LFSA) in Malaysia; NEBA Private Clients (PTY) Ltd, authorised by the Financial Sector Conduct Authority (FSCA) in South Africa. NEBA Private Clients UK is licensed by the Financial Conduct Authority (FCA)

If you are a client outside the United Kingdom, please note that our services are not covered by the UK’s regulatory framework. This means that protections from the Financial Conduct Authority (FCA) and the UK Financial Ombudsman Service will not apply. Instead, your relationship with us will be governed by the laws and dispute resolution processes of the jurisdiction where you receive our services, which will differ from those in the UK.

The investment return and the principal value are subject to market fluctuations. Consequently, an investment, upon redemption, may be worth less than the initial amount invested. Past performance is not indicative of future returns, and we cannot guarantee the success of any investment strategy.

Neville Montagu Group, Hudson House, 8 Albany Street, Edinburgh EH1 3QB

© 1998 – 2025 Neville Montagu